Florida’s Definition of Life Insurance Replacement? Replacement refers to the act of discontinuing an existing policy to purchase a new one. This process necessitates a thorough comparison to ensure the new policy offers equal or better benefits.

Understanding Florida’s specific regulations on life insurance replacement helps policyholders make informed decisions. It’s crucial to evaluate the terms, coverage, and costs involved in replacing a life

insurance policy. Given that life insurance serves as a safeguard for one’s beneficiaries, undertaking a replacement can have long-term financial implications.

The Florida Department of Financial Services sets out guidelines to protect consumers, ensuring transparency and fair dealing in the life insurance market. Keeping these guidelines in mind, one must

thoroughly assess the reasons for considering replacement and the potential benefits it may provide. It’s a significant decision that demands careful consideration, highlighting the importance of understanding the policy specifics and the state’s regulatory framework.

The Essence Of Life Insurance Replacement

Understanding the essence of life insurance replacement is crucial. People’s needs change over time, which might lead to a reconsideration of their existing life insurance policies. This is where the concept of replacing an existing life insurance policy comes in, with the objective to better aligning with current needs, possibly providing more benefits, or reflecting an improved financial situation.

What Constitutes Replacement?

What Constitutes Replacement?

When discussing life insurance, replacement refers to canceling an old policy and taking out a new one. It’s a crucial decision that demands thoughtful consideration. The process involves several key steps:

- Evaluation of current life insurance coverage.

- Comparison with potential new policies.

- Understanding the terms and conditions of both old and new.

- Calculating the financial implications, including costs and benefits.

Florida’s Definition of Life Insurance Replacement?Stance On Life Insurance Replacement

Florida has clear regulations on life insurance replacement to protect policyholders. It defines replacement as a transaction where a new policy is purchased, and an existing one is surrendered or significantly changed. Strict guidelines ensure that any replacement provides actual value to the policyholder. Key points of Florida’s approach include:

| Requirement | Details |

|---|---|

| Disclosure | Agents must disclose if the new policy replaces the old one. |

| Comparison | A side-by-side comparison of policies is necessary. |

| Documentation | Written documents outlining the replacement reasons are required. |

| Waiting Period | There’s a period to reconsider the replacement decision. |

By mandating these points, Florida’s regulations aim to create a transparent process that serves the best interest of those looking to replace their life insurance coverage.

Navigating Florida Regulations

Navigating the intricacies of insurance regulations in Florida need not be complex. Understanding the definition of life insurance replacement in Florida requires insight into state laws and regulatory practices. This post sheds light on the key aspects of life insurance replacement and how they apply within the Sunshine State.

State Statutes And Guidelines

The State of Florida outlines specific statutes for life insurance replacement. These laws aim to protect policyholders from uninformed decision-making during a policy switch. The statutes include:

- Assessing the need for replacement

- Comparing old and new policy benefits

- Understanding potential consequences of switching

In Florida, the term ‘replacement’ refers to cancelling an existing life insurance policy or annuity to obtain a new one. To ensure this process is in the policyholder’s best interest, specific guidelines are in place.

Regulatory Bodies And Enforcement

The Florida Office of Insurance Regulation (FLOIR) plays a crucial role in overseeing life insurance replacements. This body enforces regulations and protects consumers. They ensure fair practices in the insurance industry.

FLOIR’s responsibilities include:

- Reviewing insurance policies

- Monitoring company compliance

- Taking action against violations

Insurers must provide a ‘Notice to Applicant’ form. This form explains the repercussions of replacing a policy. Regulatory enforcement ensures transparency in all insurance transactions.

Criteria For Replacement In Florida

Understanding the Criteria for Replacement in Florida is vital for making informed decisions about life insurance. The state defines “replacement” as a situation where a new policy is bought. It replaces the old. This process involves specific criteria to safeguard policyholders’ interests. Knowing when a replacement occurs and the associated rules helps consumers choose wisely.

Comparing Policies: When Does Replacement Occur?

Replacement happens under certain conditions. Consumers must look at these conditions closely. Here’s a brief rundown:

-

- Cancellation of the existing policy: The action triggers replacement.

- Reduction in benefits: Changes might indicate a new policy.

- Changes in premiums: Newer policies might alter payment terms.

Documentation And Disclosure Requirements

Florida law mandates clear documentation and disclosure during replacement:

-

- A written notice to the policy owner about replacement is required.

- A detailed comparison between policies must be provided.

- Insurers have to keep a record of disclosures for a set period.

:max_bytes(150000):strip_icc()/does-homeowners-insurance-cover-roof-replacement-v2-e0e8219dfb9c4dceabe765b0a03768a6.jpg)

Motivations Behind Policy Replacement

People often think about changing their life insurance policies. They look for new policies for many reasons. One main reason is to get a better deal. Some want to save money. Others want more benefits. It is important to understand why people switch policies in Florida.

The Pursuit Of Better Terms

Finding a policy with better terms is a key motivator. New policies may offer improved features. These features might include:

- Lower premiums: less money spent each month.

- Higher coverage means More protection for the family.

- Added benefits: things like cash value or living benefits.

Insurance companies often update their products. Better options may become available over time.

Financial Implications For Policyholders

Switching policies has financial effects. Saving money is a priority for many. New policies might offer cost savings. But there are things to consider, such as:

| Savings | Costs |

|---|---|

| lower monthly costs | Fees when changing policies |

| tax benefits | New medical exams may be needed |

One must compare the old and new policy carefully. Look at the long-term value, not just short-term savings.

The Impact On Consumers

The Impact on Consumers of life insurance replacement in Florida involves understanding the potential benefits and risks. This evaluation helps policyholders make informed decisions. Making the right choice can lead to improved coverage and cost savings. On the other hand, it could also lead to unexpected disadvantages.

Advantages Of Policy Replacement

Policy replacement in Florida may offer several benefits:

- Updated Coverage: Aligns policies with current life circumstances.

- Better Premiums: Could offer lower payments for similar coverage.

- Enhanced Benefits: New policies may have additional features.

Potential Risks And Downsides

However, replacing a life insurance policy also has its potential risks:

- Surrender Charges: Early termination could lead to fees.

- New Contestability Period: Possible delay in benefits due to a new waiting period.

- Medical Re-evaluation: Health changes can affect premiums or coverage eligibility.

The Role Of Agents And Insurers

The Role of Agents and Insurers in the context of Florida’s definition of life insurance replacement is crucial. These professionals play a pivotal role in guiding policyholders through the intricacies of replacing their life insurance policies. Their expertise ensures that clients make informed decisions, safeguarding their interests. Now, let’s delve into the duties and responsibilities entailed in this process, as well as the challenges faced when advising clients on life insurance replacements.

Duties And Responsibilities

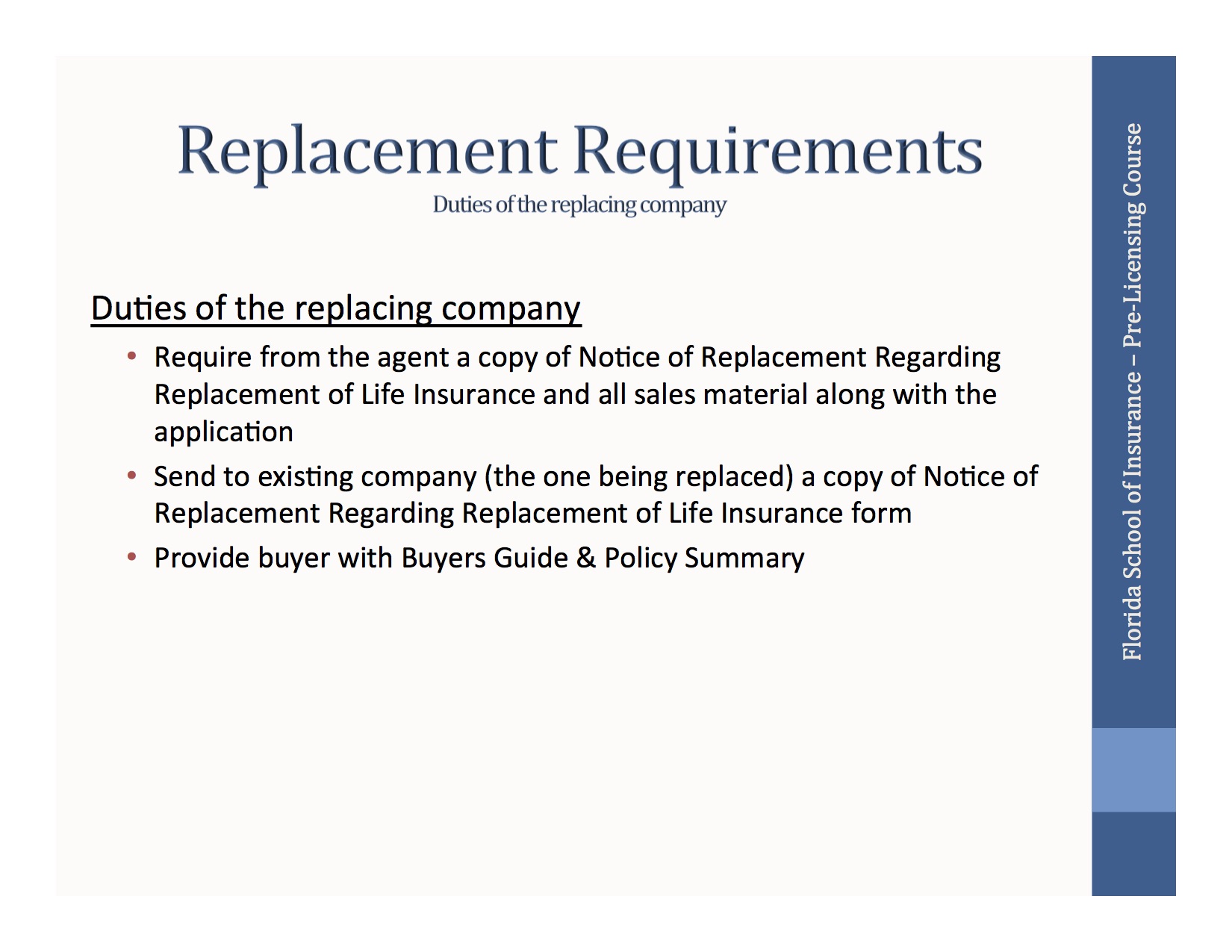

Agents and insurers shoulder a significant burden of responsibility. They must understand and adhere to the legal requirements set forth in Florida’s insurance regulations. Their tasks include:

- Evaluating client needs: Agents must assess the client’s current coverage and future requirements.

- Comparing policies: They should compare the benefits and costs of existing policies against new ones.

- Disclosure: They are required to provide full disclosure of the terms and conditions of policy replacement.

- Documentation: They must ensure all paperwork is completed correctly and submitted timely.

They must also confirm that the client understands the potential consequences, such as surrender charges or new contestability periods.

Challenges In Advising Clients

Advising clients on life insurance replacement comes with its own set of complexities:

- Understanding client goals: Ensuring clients’ goals align with the advice given can be difficult.

- Regulatory compliance: Staying updated on state-specific insurance regulations is a must.

- Managing expectations: Clients must grasp the long-term impact of replacing their policy.

Agents often navigate a delicate balance between client needs and regulatory demands, which requires expertise and due diligence.

Legal Recourse For Unfair Practices

Florida has clear regulations on life insurance replacement.

Unfair practices can put policyholders at a disadvantage. The state provides legal ways to address these issues.

Know your rights and the steps to take if you face unfair practices.

Consumer Rights And Protections

In Florida, policyholders have certain protections when replacing life insurance.

The law ensures full disclosure by insurance agents and companies.

Consumers must receive all the facts about how a replacement affects them.

- Right to a Summary Comparison: Clear understanding of the old and new policies.

- Free Look Period: Time to review the new policy without penalty.

- Full Disclosure: Details of charges or benefits lost in the replacement process.

Navigating Disputes And Complaints

Dealing with insurance disputes can be tough. Florida provides a structured process

to help. You can submit a complaint to the Florida Department of Financial Services.

- Contact your insurance company first. Give them a chance to resolve the issue.

- If unresolved, file a complaint with the state. This might be online or by mail.

- Provide all the necessary details. These include policy numbers and a description of the issue.

- The state reviews your complaint. They ensure a fair examination and response.

Stand up for your rights.

Seek justice if you encounter unfair life insurance replacement practices in Florida.

:max_bytes(150000):strip_icc()/workers-compensation.asp-final-f97e35419bc74ee4b5d52b66799da153.png)

Future Outlook

Changing dynamics in the life insurance industry affect policies across the United States,

including Florida. Consumers and insurers alike are gearing up for an evolution shaped by

technological advancements and regulatory updates.

Emerging Trends In Life Insurance

The life insurance scene is brimming with innovation.

Here’s what’s trending:

- Technology integration streamlines the application and claims processes.

- Customization offers personalized policy options.

- Data analytics fine-tune risk assessment and pricing.

- Wearables and health apps dive into lifestyle-based insurance models.

Florida’s Evolving Regulatory Landscape

With new regulations, Florida’s insurance sector seeks enhanced consumer protection.

Notable regulatory shifts include:

- Stricter guidelines for policy replacement to prevent potential drawbacks.

- Increased transparency in insurance dealings.

- Regular audits to ensure compliance and fairness.

- Emphasis on informed consent for policy replacements.

In Florida, agents are allowed to engage in rebating if

In Florida, agents are allowed to engage in rebating if they adhere to specific guidelines set forth by the state’s insurance regulations. Rebating involves returning a portion of the agent’s commission to the

client or offering them an incentive, such as a gift or service. To comply with Florida law, any rebate must be clearly documented in the insurance contract and uniformly available to all clients under

similar circumstances, ensuring that no discrimination occurs. Additionally, the rebate must not be misleading or deceptive, and the agent must keep detailed records of all rebating transactions for

regulatory review. This practice aims to foster transparency and fairness in the insurance industry while providing potential cost savings to policyholders.

Which of the following situations is not subject to Florida life insurance laws?

Certain situations are not subject to Florida life insurance laws, thereby exempting them from the state’s regulatory framework. These exemptions typically include policies issued to non-residents

who apply for insurance while outside the state, policies issued by insurers not authorized to operate in Florida but regulated by another jurisdiction, and group life insurance policies where the master

policyholder resides outside of Florida, even if some members of the group are Florida residents. Additionally, policies related to employer-employee relationships under specific federal laws

and insurance provided by fraternal benefit societies are often not governed by Florida life insurance statutes. These exclusions are designed to prevent jurisdictional overlap and ensure that insurance practices align with the appropriate regulatory environment.

Frequently Asked Questions

What Is the Definition of Life Insurance Replacement?

Life insurance replacement is the act of canceling an existing policy to buy a new one. This could involve changing providers or policy terms.

What Is Florida’s Definition of Life Insurance Replacement Quizlet?

Florida defines life insurance replacement as the act of substituting a new policy for an existing one. This process may involve cancellation or changes in coverage, terms, or companies.

What Is Florida’s Definition of Life Insurance?

Florida defines life insurance as a contract where an insurer promises to pay a beneficiary a sum of money in exchange for premiums upon the insured person’s death.

Which of the following transactions would be considered a life insurance policy replacement?

A life insurance policy replacement occurs when an existing policy is surrendered, lapsed, or altered to obtain a new one.

Conclusion

Navigating the intricacies of life insurance replacement in Florida is essential for making informed decisions. Ensure you fully understand the state’s regulations and seek expert advice if needed.

Selecting the appropriate policy, informed by the Sunshine State’s unambiguous definitions, is the first step towards safeguarding your financial future.

Your peace of mind is worth this careful consideration.

Hello and welcome to HealthcareInsuranceNews.com! I’m Emon Sheikh, and I’m thrilled to be your guide through the intricate world of healthcare insurance.

As a dedicated blog writer focusing on healthcare insurance, I’m passionate about helping individuals navigate the complexities of insurance policies, understand their coverage options, and make informed decisions to protect their health and finances.

With a background in Life Insurance, Travel Insurance, Medical Insurance, Pet Insurance, Students Insurance, Cancer Insurance, I bring a wealth of knowledge and insights to my writing. Through my blog posts, I aim to demystify insurance jargon, provide practical tips, and keep you up-to-date on the latest developments in the healthcare insurance landscape.

Whether you’re a seasoned insurance professional, a healthcare provider, or someone simply seeking guidance on finding the right insurance plan, I’m here to provide valuable information and support. Together, let’s unravel the complexities of healthcare insurance and empower you to take control of your healthcare journey.

Thank you for visiting HealthcareInsuranceNews.com, and I look forward to sharing this journey with you!

Best regards,

Emon Sheikh