**Should I Accept First Offer from Insurance Company for Car? ** It’s usually not advisable to accept the first offer from an insurance company.

They often start with a low settlement. Insurance companies aim to settle claims quickly and cost-effectively. Their initial offer often reflects this goal, rather than the true value of your claim.

By accepting the first offer, you might miss out on fair compensation. Evaluating the offer carefully and considering a counteroffer can lead to a better settlement.

Research your car’s market value, repair costs, and any other expenses related to the accident. Consulting with a professional or an attorney can also provide valuable insights. Taking these steps ensures that you receive a fair and just settlement for your claim.

Initial Offer Dynamics

Receiving an initial offer from an insurance company can be confusing. Understanding the dynamics behind this first offer is crucial. This section will explore why insurers start with low offers and what to expect during negotiations.

Why Insurers Start Low

Insurance companies often start with a low offer. They aim to save money. By offering less, they hope you will accept quickly. This strategy benefits them financially.

Insurers know some people need quick cash. They use this urgency to their advantage. A low initial offer can be tempting for those in immediate need.

Starting low gives insurers room to negotiate. They expect a counteroffer. By starting low, they can increase their offer while still saving money.

Negotiation Expectations

Negotiation is a key part of dealing with insurance claims. Expect the process to involve back-and-forth discussions. Prepare yourself with facts and figures.

Have documentation ready. This includes repair estimates, medical bills, and any other relevant costs. Clear evidence strengthens your position.

Be patient and persistent. Insurers may try to delay or lowball your counteroffer. Stand firm and reiterate your needs.

Consider hiring a professional. A lawyer or claims adjuster can help. They understand the intricacies of insurance negotiations.

Remember, you don’t have to accept the first offer. Your goal is fair compensation. Taking time to negotiate can lead to a better outcome.

Understanding Your Claim

Understanding Your Claim is crucial when dealing with car insurance companies. They often try to settle quickly, but their first offer might not be fair. Knowing the details of your claim helps you get the compensation you deserve.

Assessing Vehicle Damage

Begin by inspecting your car for visible damages. Take clear photos from multiple angles. This visual evidence supports your claim. Keep a record of all repair estimates from reputable mechanics.

Next, compare these estimates to the first offer from the insurance company. If their offer is lower, you have grounds to negotiate. Always use the repair estimates as leverage.

Document any other related expenses. This includes towing fees, rental car costs, and any temporary fixes. These should also factor into the total claim amount.

Calculating Injury Costs

Injury costs often exceed vehicle damages. Start by documenting all medical expenses. This includes hospital visits, medication, and therapy sessions. Keep all receipts and medical records.

Consider potential future medical expenses. Injuries sometimes require long-term treatment. Obtain a written statement from your doctor about future care costs.

Also, account for lost wages. If your injury prevents you from working, you deserve compensation for this loss. Provide your salary statements and a note from your employer to support this claim.

Below is a table summarizing key points for easy reference:

| Category | Action |

|---|---|

| Vehicle Damage | Take photos, get repair estimates, record all expenses |

| Injury Costs | Document medical expenses, future costs, and lost wages |

By understanding your claim, you can confidently negotiate a fair settlement. Always ensure all your expenses are well-documented.

The Risks Of Immediate Acceptance

Accepting the first offer from an insurance company can be tempting. The process is quick and hassle-free. But there are significant risks involved. These include potential underpayment and overlooking long-term costs. It’s crucial to understand these risks before making a decision.

Potential Underpayment

Insurance companies aim to minimize their payouts. Their initial offers are often lower than what you deserve. This is called potential underpayment.

Consider this scenario:

- Your car repair costs are $5,000.

- The insurance company offers you $3,000.

By accepting the first offer, you lose $2,000. This amount can cover additional expenses or future repairs. Always evaluate the offer carefully. Compare it with repair estimates from multiple sources.

Overlooking Long-term Costs

Immediate acceptance might save time but can lead to bigger problems. Overlooking long-term costs is a common issue.

Let’s break this down:

- Your car requires ongoing maintenance after the accident.

- Medical treatments might be necessary.

- Future insurance premiums could increase.

These costs add up over time. The first offer might not cover these expenses. Think about the future impact on your finances.

Use a table to compare immediate and long-term costs:

| Immediate Costs | Long-Term Costs |

|---|---|

| Car Repair | Ongoing Maintenance |

| Initial Medical Bills | Future Medical Treatments |

| Short-term Car Rental | Increased Insurance Premiums |

Reviewing these factors ensures you make an informed decision. Avoid the pitfalls of immediate acceptance. Think about the bigger picture.

Negotiation Benefits

Negotiating with an insurance company can save you money. Many people accept the first offer, but that might not be the best choice. Knowing the benefits of negotiation can help you get a better deal.

Leveraging Better Settlements

When you negotiate, you can often get more money. Insurance companies might offer a low amount first. They do this hoping you accept it quickly. But you can ask for more. Here are some tips:

- Gather Evidence: Collect photos, repair estimates, and witness statements.

- Know Your Car’s Value: Check online tools like Kelley Blue Book.

- Be Firm but Polite: State your case clearly and respectfully.

These tips can help you get a fairer settlement. You deserve the best value for your car.

Time To Consult Experts

Sometimes, you need expert help. This can be especially true if the damage is severe. Here are some experts to consider:

| Expert | How They Help |

|---|---|

| Auto Appraisers | They provide a fair value for your car. |

| Lawyers | They can negotiate and handle legal issues. |

| Mechanics | They give accurate repair estimates. |

Consulting with these experts can strengthen your case. They provide valuable insights and support.

Legal Considerations

Deciding whether to accept the first offer from an insurance company can be tricky. Understanding the legal considerations will help you make an informed choice. This section covers binding agreements and rights to fair compensation.

Binding Agreements

When you accept the first offer, you may enter into a binding agreement. This means you cannot ask for more money later.

Insurance companies often want you to sign a release form. This form states you accept their offer and won’t pursue further claims.

Before signing any document, read it carefully. You might want to consult a lawyer. This way, you know your rights and obligations.

Rights To Fair Compensation

Every policyholder has the right to fair compensation. Insurance companies must offer a fair amount for your loss.

If the first offer seems low, you have the right to negotiate. You can also ask for a detailed explanation of the offer.

Sometimes, hiring an independent appraiser helps. They can evaluate the damage and provide an unbiased estimate.

| Action | Why It’s Important |

|---|---|

| Consult a Lawyer | To understand the legal terms and protect your rights. |

| Read Documents Carefully | To know what you are agreeing to. |

| Hire an Appraiser | To get an independent damage estimate. |

Remember, you don’t have to accept the first offer. Your rights to fair compensation allow you to seek a better deal.

The Role Of Attorneys

Dealing with insurance companies can be tricky. They may not offer you what you deserve. This is where attorneys come in. They know the laws and can fight for you. Let’s dive into how they can help.

When To Hire A Lawyer

Knowing when to hire a lawyer is crucial. Here are some scenarios:

- Your claim is denied.

- The offer seems too low.

- You feel pressured to accept the first offer.

- You are unsure about the legal terms.

In these cases, a lawyer can guide you. They will ensure you get what you deserve.

How Legal Aid Can Help

Legal aid can offer many benefits. Here’s how:

| Benefit | Description |

|---|---|

| Expert Advice | Attorneys provide expert advice on your claim. |

| Negotiation | They can negotiate better offers for you. |

| Legal Representation | They represent you in court if needed. |

| Peace of Mind | You can relax knowing someone is fighting for you. |

Attorneys make sure your rights are protected. They handle the tough negotiations. This can relieve your stress.

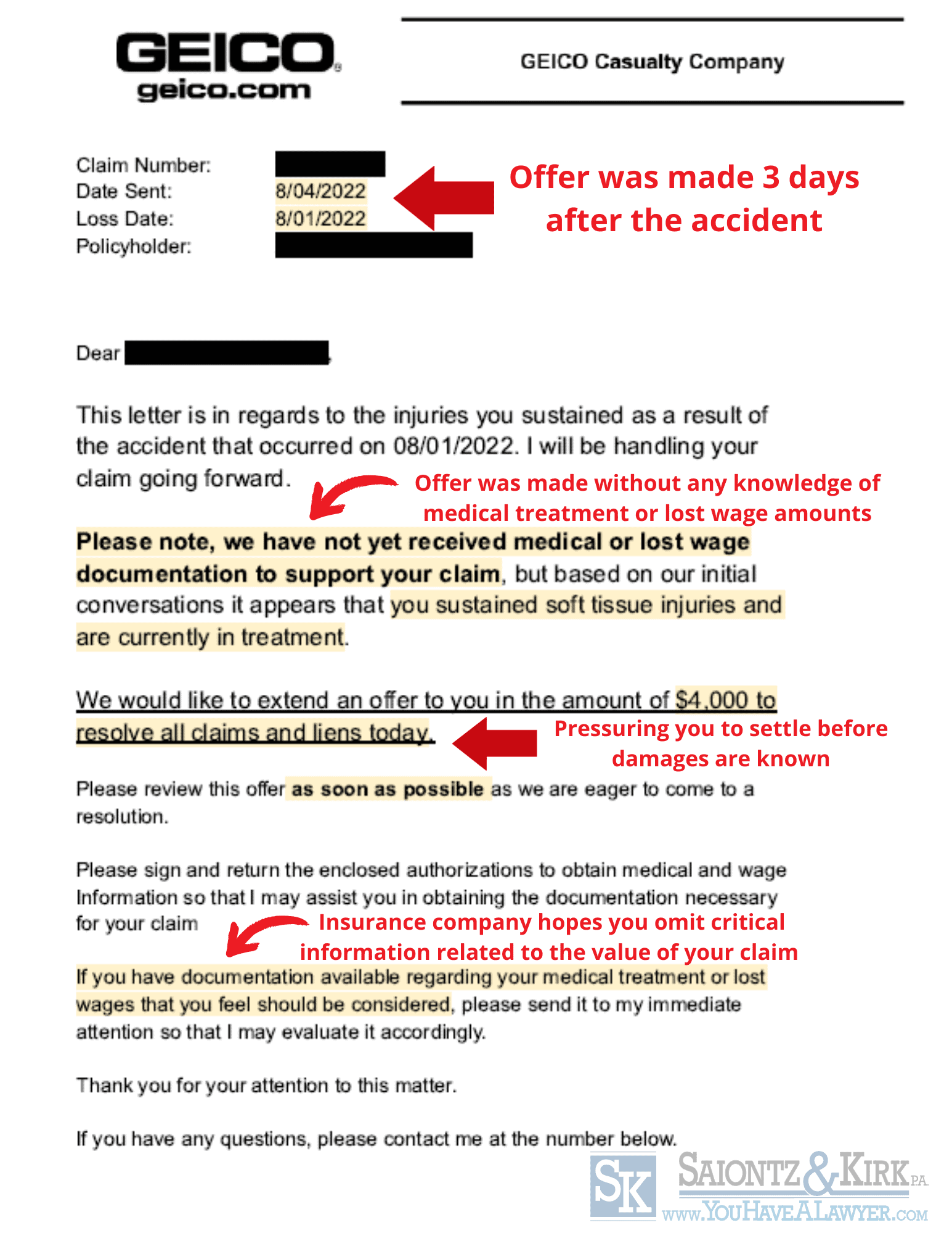

Insurance Adjusters’ Tactics

Understanding insurance adjusters’ tactics can help you make better decisions. Insurance companies train adjusters to minimize payouts. Knowing their strategies can help you respond effectively.

Common Strategies Used

Insurance adjusters use various tactics to reduce your claim amount. Here are some common strategies:

- Quick Offers: Adjusters offer a quick settlement before you know your damage’s full extent.

- Lowball Offers: They offer less than your claim’s actual value.

- Delaying Tactics: They delay the process, hoping you’ll settle for less out of frustration.

- Questioning Fault: Adjusters may question who is at fault to reduce the payout.

How To Respond Effectively

Knowing how to respond can help you get a fair settlement. Follow these tips:

- Stay Calm: Do not accept the first offer without reviewing it.

- Gather Evidence: Collect all necessary documents and evidence.

- Know Your Policy: Understand what your insurance policy covers.

- Get a Second Opinion: Consult a lawyer or a claims adjuster.

- Negotiate: Do not be afraid to ask for a higher amount.

By understanding these tactics, you can navigate the insurance claim process better. Make informed decisions to ensure you receive a fair settlement.

Final Thoughts Before Deciding

Deciding to accept the first offer from your car insurance company is crucial. You need to consider multiple factors to make an informed decision. This section will guide you through weighing the offer and understanding its long-term implications.

Weighing The Offer

First, evaluate the offer carefully. Compare it with your car’s actual value. Use online tools to check your car’s market value. Here’s a simple checklist to help you:

- Research your car’s market value.

- Check for any hidden costs.

- Consult with a professional appraiser.

Let’s create a table to compare the offer with your car’s market value:

| Criteria | Insurance Offer | Market Value |

|---|---|---|

| Car’s Condition | Good | Excellent |

| Year of Manufacture | 2018 | 2018 |

| Mileage | 50,000 miles | 45,000 miles |

Long-term Implications

Think about the long-term implications of accepting the offer. Will it cover future repair costs? Will it affect your premium rates?

- Consider future repair costs.

- Check if accepting the offer affects your premium rates.

- Consult with a financial advisor.

Consulting with a financial advisor can help you make a better decision. They can provide insights into the long-term financial impact.

How long does it take to get a second settlement offer

The time it takes to receive a second settlement offer can vary significantly depending on several factors, including the complexity of the case, the responsiveness of both parties, and the negotiation process.

Typically, after the initial offer is reviewed and potentially rejected, it may take anywhere from a few days to several weeks for the insurance company or opposing party to evaluate the counterarguments and reassess their position.

This period allows for additional investigations, consultations with experts, and internal approvals, which can all contribute to the timeline.

Communication between attorneys, the submission of further documentation, and strategic considerations also play a role in the timing. It’s essential to maintain clear and prompt communication with your legal representative to expedite the process and ensure all necessary information is provided promptly.

Should I accept first insurance settlement offer

It’s important to think carefully before accepting the initial insurance settlement offer. Generally, the initial offer from an insurance company is lower than what you might be entitled to, as insurers aim to minimize their payouts.

Before accepting, it’s crucial to assess the full extent of your damages, including medical expenses, property damage, lost wages, and any future costs related to your injury or loss.

Consulting with a legal professional can provide valuable insights into the fairness of the offer and help you understand your rights and potential compensation.

Gathering thorough documentation and potentially negotiating for a higher amount can ensure you receive a settlement that adequately covers your needs.

Accepting the first offer without proper evaluation might lead to insufficient compensation, leaving you with out-of-pocket expenses down the line.

Frequently Asked Questions

Is It Better To Accept A Settlement Offer?

Accepting a settlement offer depends on your situation. Evaluate the offer carefully and consult a legal professional.

How Do You Politely Decline An Insurance Offer?

Thank you for the offer, but I am not interested at this time. I appreciate your understanding.

How Do I Reject A Low Settlement Offer?

To reject a low settlement offer, politely decline in writing. State your reasons clearly. Provide supporting evidence. Suggest a counteroffer. Consult with your attorney for further guidance.

Can You Negotiate A Car Settlement Figure?

Yes, you can negotiate a car settlement figure. Contact your insurance company and present your case. Be prepared with evidence like repair estimates and market values.

Conclusion

Deciding to accept the first offer from an insurance company requires careful consideration. Evaluate the offer thoroughly. Consult with professionals if necessary. Ensure you receive fair compensation for your car. Taking these steps can help you make an informed decision.

Always prioritize your best interests and financial well-being.

Hello and welcome to HealthcareInsuranceNews.com! I’m Emon Sheikh, and I’m thrilled to be your guide through the intricate world of healthcare insurance.

As a dedicated blog writer focusing on healthcare insurance, I’m passionate about helping individuals navigate the complexities of insurance policies, understand their coverage options, and make informed decisions to protect their health and finances.

With a background in Life Insurance, Travel Insurance, Medical Insurance, Pet Insurance, Students Insurance, Cancer Insurance, I bring a wealth of knowledge and insights to my writing. Through my blog posts, I aim to demystify insurance jargon, provide practical tips, and keep you up-to-date on the latest developments in the healthcare insurance landscape.

Whether you’re a seasoned insurance professional, a healthcare provider, or someone simply seeking guidance on finding the right insurance plan, I’m here to provide valuable information and support. Together, let’s unravel the complexities of healthcare insurance and empower you to take control of your healthcare journey.

Thank you for visiting HealthcareInsuranceNews.com, and I look forward to sharing this journey with you!

Best regards,

Emon Sheikh